In the world of finance and accounting, invoice matching plays a crucial role in ensuring accuracy and efficiency in the payment process. One common question that arises is the difference between 2-way and 3-way invoice matching. Understanding these two methods is essential for businesses to streamline their financial operations effectively.

Understanding Invoice Matching

Before delving into the differences between 2-way and 3-way invoice matching, let’s first define what invoice matching is and why it is important.

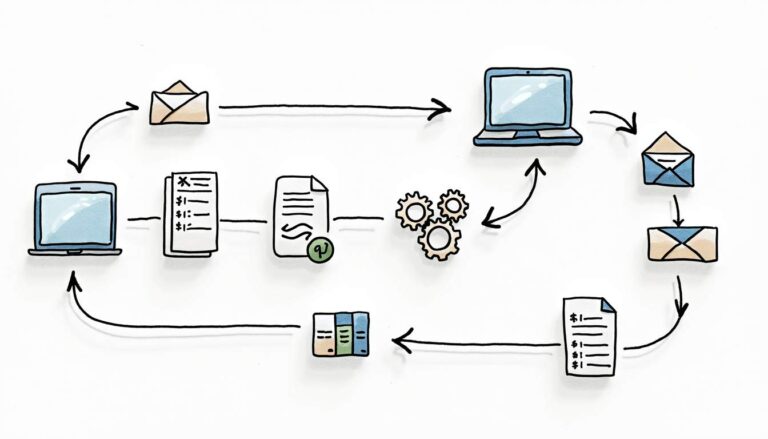

Invoice matching is an essential process in the realm of financial management. It involves meticulously comparing the details of an invoice with the corresponding purchase order and receipt of goods or services. Its purpose is to verify that the prices, quantities, and terms are consistent and correct.

Now, let’s explore the intricacies of invoice matching in more detail.

Definition of Invoice Matching

Invoice matching, also known as three-way matching, is a critical step in the accounts payable process. It involves comparing the information on an invoice with the corresponding purchase order and receipt of goods or services.

During the invoice matching process, each line item on the invoice is meticulously compared to the corresponding line item on the purchase order and receipt. The matching criteria typically include the item description, quantity, unit price, and any applicable discounts or taxes.

By ensuring that all the details align across these three documents, businesses can validate the accuracy of the invoice and identify any discrepancies or errors that may have occurred during the procurement process.

Importance of Invoice Matching

Invoice matching serves as a control mechanism to prevent errors, discrepancies, or fraudulent activities in the payment process. It acts as a safeguard for businesses, ensuring that they only pay for the goods or services they have received and that the prices and terms are in line with the agreed-upon terms.

Accurate invoice matching is crucial for maintaining financial integrity and preventing financial losses. By verifying the accuracy of invoices, businesses can minimize the risk of overpayment, duplicate payments, or unauthorized purchases.

Moreover, invoice matching plays a vital role in maintaining strong vendor relationships. By promptly identifying and resolving any discrepancies or issues, businesses can foster trust and collaboration with their suppliers, ensuring a smooth and efficient procurement process.

Furthermore, invoice matching provides valuable insights into the overall efficiency of the procurement process. By analyzing the frequency and nature of discrepancies, businesses can identify areas for improvement, streamline their operations, and optimize their cash flow management.

In conclusion, invoice matching is a crucial process that ensures the accuracy and integrity of financial transactions. By meticulously comparing invoices, purchase orders, and receipts, businesses can mitigate financial risks, maintain strong vendor relationships, and optimize their procurement processes.

Exploring 2-Way Invoice Matching

Now, let’s delve into the concept of 2-way invoice matching and understand its advantages and disadvantages.

When it comes to managing invoices, accuracy and efficiency are key. One method that businesses use to ensure the accuracy of their invoices is 2-way invoice matching. In this process, the invoices are matched against the purchase orders only. This means that the focus is primarily on verifying the prices and quantities mentioned in the invoice, ensuring they align with the purchase order.

By comparing the invoice with the purchase order, businesses can quickly identify any discrepancies in pricing or quantities. This helps in preventing overpayment or underpayment to suppliers, ensuring that the financial transactions are accurate and in line with the agreed terms.

One advantage of 2-way invoice matching is its simplicity. Since it involves comparing invoices with purchase orders only, it requires less time and effort compared to the 3-way matching process. This makes it an attractive option for businesses that have a higher volume of low-value transactions. By streamlining the invoice matching process, businesses can save valuable time and resources, allowing them to focus on other important aspects of their operations.

However, it is important to note that 2-way invoice matching has its limitations. The major drawback is that it does not consider the receipt of goods or services. While it ensures that the prices and quantities mentioned in the invoice are accurate, it does not take into account whether the goods or services were actually received or if they were in good condition.

This means that there is a possibility of paying for items that were not received or were damaged. For businesses that deal with high-value transactions or rely heavily on the quality and condition of the received goods or services, 2-way invoice matching may not provide sufficient control and assurance.

Despite its limitations, 2-way invoice matching can still be a valuable tool for businesses. By focusing on the prices and quantities mentioned in the invoice, it provides a basic level of verification and helps in preventing payment errors. However, businesses should carefully evaluate their specific needs and requirements before deciding whether to adopt 2-way invoice matching as their primary invoicing process.

Delving into 3-Way Invoice Matching

Now, let’s delve into the concept of 3-way invoice matching and explore its benefits and drawbacks.

Invoice matching is a critical process for businesses to ensure accuracy and efficiency in their financial operations. It involves comparing invoices with other relevant documents, such as purchase orders and receipts, to validate the accuracy of the information provided by suppliers. While traditional invoice matching focuses on comparing invoices with purchase orders, 3-way invoice matching takes it a step further by incorporating the verification of goods or services receipt.

Concept of 3-Way Invoice Matching

In 3-way invoice matching, invoices are matched against purchase orders, as well as receipts of goods or services. This method ensures that not only the prices and quantities but also the confirmation of delivery or performance are in sync with the invoices.

Let’s say a company places an order for a specific quantity of products from a supplier. The supplier then delivers the goods along with a receipt, confirming the delivery. The company’s accounts payable department receives the invoice from the supplier, which includes the details of the order, such as the quantity, price, and other relevant information. To perform a 3-way invoice match, the accounts payable team compares the invoice with the purchase order and the receipt to ensure that all three documents align. This process helps to identify any discrepancies, such as incorrect quantities, pricing errors, or missing deliveries.

By incorporating the receipt verification step, 3-way invoice matching provides an additional layer of control and accuracy in the invoice reconciliation process. It helps businesses avoid overpaying for goods or services that were not received or were of substandard quality. This method acts as a safeguard against fraudulent activities and ensures that businesses only pay for what they have actually received.

Pros and Cons of 3-Way Invoice Matching

One advantage of 3-way invoice matching is its comprehensive nature. By verifying the receipt of goods or services, businesses can minimize the risk of paying for undelivered or substandard items. It also enhances the control over inventory management and vendor performance evaluation.

Additionally, 3-way invoice matching provides a clear audit trail, making it easier for businesses to track and resolve any discrepancies. It improves transparency and accountability in the procurement process, allowing companies to maintain accurate financial records and comply with regulatory requirements.

Nevertheless, the downside of 3-way invoice matching is the added complexity and time required to reconcile multiple documents. This method may not be suitable for businesses with a high volume of transactions or those dealing with low-value items. The process of matching invoices, purchase orders, and receipts can be time-consuming and resource-intensive, especially when dealing with a large number of transactions.

Furthermore, implementing 3-way invoice matching requires robust systems and technology infrastructure to handle the increased workload. Businesses need to invest in reliable software solutions that can automate the matching process and streamline the reconciliation tasks. Without the necessary tools and resources, the benefits of 3-way invoice matching may be overshadowed by the operational challenges it presents.

In conclusion, while 3-way invoice matching offers significant advantages in terms of accuracy and control, it is essential for businesses to carefully evaluate their specific needs and capabilities before implementing this method. By considering factors such as transaction volume, complexity, and available resources, companies can determine whether 3-way invoice matching is the right fit for their financial operations.

Key Differences between 2-Way and 3-Way Invoice Matching

Now, let’s compare the process complexity and other factors associated with 2-way and 3-way invoice matching.

Comparison of Process and Complexity

2-way invoice matching involves comparing invoices against purchase orders, making it relatively simple and straightforward. On the other hand, 3-way invoice matching adds the additional step of comparing invoices with purchase orders and receipts, increasing the complexity of the reconciliation process.

Comparison of Accuracy and Efficiency

While 2-way invoice matching is efficient for businesses with a high volume of low-value transactions, it may lead to a higher risk of discrepancies or payment errors. In contrast, 3-way invoice matching ensures greater accuracy by considering the receipt of goods or services, but it may require more time and resources to complete the process.

Choosing the Right Invoice Matching Method

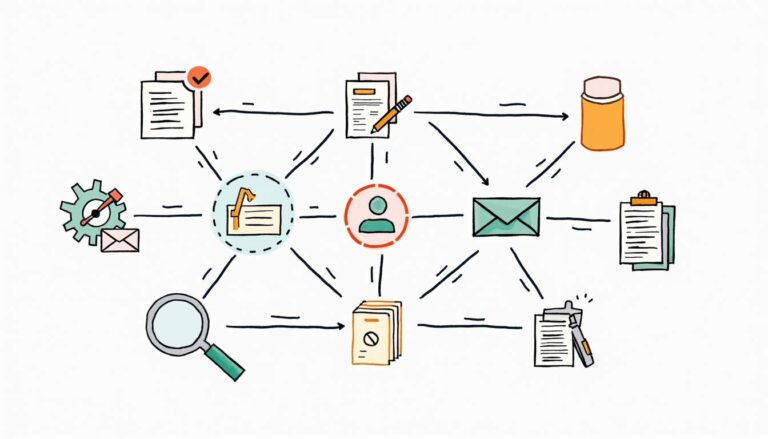

When deciding between 2-way and 3-way invoice matching, businesses must consider various factors to determine the most suitable method for their operations.

Factors to Consider

Firstly, businesses need to evaluate their transaction volume and value. If dealing with a high volume of low-value transactions, 2-way invoice matching might be appropriate. Conversely, if handling high-value transactions or focusing on quality control, 3-way invoice matching might be more suitable.

Secondly, businesses should assess the level of control and risk tolerance. If inventory management and vendor performance evaluation are critical, 3-way invoice matching provides a more comprehensive approach. However, if time and efficiency are paramount, 2-way invoice matching might be a better choice.

Impact on Business Operations

The choice between 2-way and 3-way invoice matching can significantly impact a business’s financial operations. Making the right decision can help minimize errors, prevent overpayment, and enhance control over the payment process. It is crucial for businesses to carefully evaluate their needs, transaction patterns, and risk tolerance before settling on a specific method.

In conclusion, the difference between 2-way and 3-way invoice matching lies in the level of detail and accuracy they provide. With 2-way matching focusing solely on purchase order verification and 3-way matching considering purchase orders, receipts, and their alignment with invoices, businesses have the flexibility to choose the most suitable method based on their specific requirements. By understanding the key differences, businesses can ensure a streamlined payment process that reduces errors and optimizes financial operations.

If you are looking to implement 2-way or 3-way invoice matching for your business, Bellwether purchasing software is the solution you need. Book a personalized demo today to see how it works.