In today’s digital age, remote work has become increasingly prevalent. With the rise of technological advancements and the desire for flexibility, many companies are embracing the concept of remote employees. However, this shift in the workforce dynamic brings about unique challenges, especially when it comes to managing expenses. In order to effectively navigate this new territory, it is crucial for companies to develop a comprehensive expense policy tailored specifically for remote employees.

Understanding the Need for a Remote Employee Expense Policy

The shift to remote work has drastically changed the way businesses operate. As employees work from different locations, there is a growing need to establish guidelines and processes regarding expenses. Without a clear expense policy in place, companies may risk financial losses and inconsistent practices.

One of the key reasons why a remote employee expense policy is essential is the unique expenses that come with remote work.

The Shift to Remote Work

Remote work offers numerous benefits for both companies and employees. Employees enjoy greater flexibility and work-life balance, while companies can tap into a larger talent pool and reduce office-related costs. According to a recent survey, 82% of remote workers reported lower stress levels compared to when they worked in a traditional office environment.

However, this shift also introduces additional costs and challenges. Remote employees often need to create a productive work environment in their homes, which may involve purchasing office equipment or upgrading internet plans. Additionally, remote workers may incur travel expenses for business meetings or conferences.

Unique Expenses of Remote Employees

Remote employees often face distinctive expenses that are not prevalent in a traditional office setting. These expenses can range from home office setup costs to increased utility bills. For instance, a remote employee may be required to purchase a desk, chair, and other necessary equipment to create an ergonomic workspace. Furthermore, remote employees may encounter higher electricity bills due to increased usage of electronic devices.

Having an expense policy that specifically addresses these unique expenses helps ensure that remote employees are fairly reimbursed and that there is consistent and transparent expense management.

Another expense that remote employees may encounter is related to internet connectivity. While working from home, a stable and reliable internet connection is crucial for seamless communication and productivity. Remote employees may need to upgrade their internet plans or invest in a higher-speed connection to effectively carry out their work responsibilities. By including provisions in the expense policy that cover internet expenses, companies can support their remote employees in maintaining a productive work environment.

In addition to home office setup and internet expenses, remote employees may also face costs associated with professional development. While working remotely, it is important for employees to stay updated with industry trends and enhance their skills. This may involve attending virtual conferences, webinars, or online courses. By including provisions in the expense policy that allow for reimbursement of these professional development expenses, companies can demonstrate their commitment to the growth and development of their remote workforce.

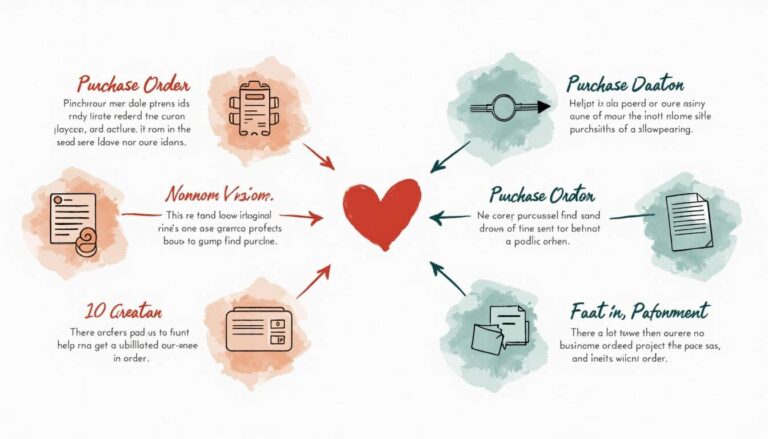

Key Components of an Effective Expense Policy

An effective remote employee expense policy consists of several key components that provide clarity and structure for both the company and its employees.

In addition to defining reimbursable expenses, setting expense limits, and establishing approval processes, there are other important aspects to consider when creating an expense policy.

Implementing a Fair and Equitable Reimbursement System

Creating a fair and equitable reimbursement system is crucial to ensure that employees are treated fairly and that the company’s resources are used responsibly. This can be achieved by establishing a clear and consistent process for submitting and reviewing expense reports.

For example, companies can implement a standardized template for expense reports, which includes fields for documenting the purpose of the expense, the date, and the amount spent. This not only helps employees provide accurate information but also streamlines the review process for managers.

Furthermore, it is important to consider the timeliness of reimbursements. Implementing a policy that ensures prompt reimbursement for approved expenses can boost employee morale and demonstrate the company’s commitment to supporting its remote workforce.

Providing Training and Resources

Another important component of an effective expense policy is providing training and resources to employees. This can help them understand the policy’s requirements and guidelines, as well as how to properly submit expense reports.

Companies can offer training sessions or create comprehensive guides that explain the policy’s key components, including examples of reimbursable expenses and how to calculate per diem rates for travel expenses. By providing employees with the necessary knowledge and resources, companies can minimize errors and ensure compliance with the policy.

Additionally, companies can establish a dedicated support system, such as a designated email address or a help desk, where employees can seek guidance or clarification regarding the expense policy. This proactive approach can help address any questions or concerns promptly, fostering a culture of transparency and open communication.

By incorporating these additional components into an expense policy, companies can create a comprehensive framework that promotes accountability, fairness, and efficiency in managing remote employee expenses.

Implementing the Expense Policy

Developing a well-crafted expense policy is just the first step. It is equally important to effectively implement and communicate the policy to all remote employees.

Communicating the Policy to Employees

Communication is key when rolling out a new expense policy. Companies can use various channels such as email newsletters, intranet portals, or virtual meetings to inform remote employees about the policy, its purpose, and any changes or updates.

But what about those employees who may have questions or need further clarification? It is essential to provide clear instructions on how to submit expense reports and what supporting documents are required. Companies should also be available to answer any questions or provide further clarification.

By taking the time to communicate effectively and address any concerns, companies can ensure that remote employees understand the policy and feel supported in their expense reporting process.

Training Managers on Expense Approval

Managers play a crucial role in enforcing the expense policy. It is important to provide them with proper training on how to effectively review and approve expenses, ensuring consistency and fairness across the organization.

But what does this training entail? Managers should be educated on the specific guidelines outlined in the expense policy, as well as any legal and compliance considerations. They should also be equipped with the necessary tools and resources to efficiently review and approve expenses.

By investing in comprehensive training for managers, companies can minimize potential errors or discrepancies in expense approval, ultimately saving time and resources.

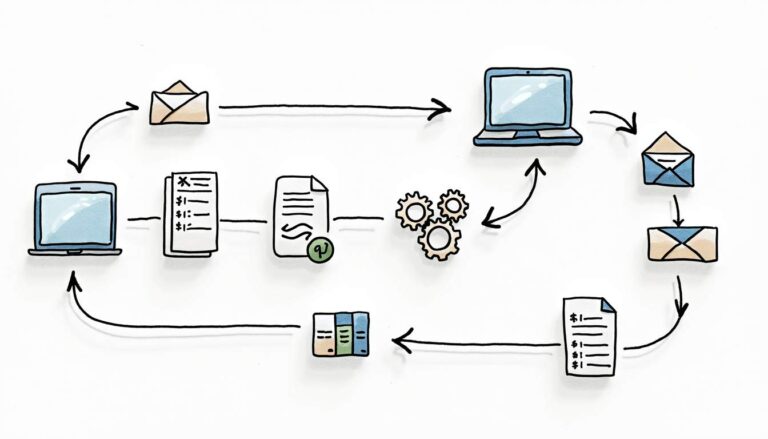

Using Technology for Expense Management

Technology can be a valuable asset in managing remote employee expenses. Implementing an expense management system can streamline the process, making it easier for employees to submit expense reports and for managers to review and approve them.

But what other benefits does technology offer? Expense management software can also generate analytics and reports, providing valuable insights into spending patterns, budget allocations, and potential cost-saving opportunities. This data can help companies make informed decisions and optimize their expense management strategies.

By leveraging technology, companies can not only simplify the expense reporting process but also gain valuable insights that can drive financial efficiency and improve overall expense management.

Maintaining and Updating Your Expense Policy

Creating an expense policy is not a one-time task. It is crucial to regularly review and update the policy to adapt to changes in the remote work landscape and address emerging needs.

Regular Review of Expense Policy

As remote work continues to evolve, it is important for companies to reassess their expense policies on a regular basis. This can help identify any outdated practices, inconsistencies, or areas for improvement.

By conducting periodic reviews, companies can ensure that their expense policies remain relevant and aligned with their business goals.

Adapting to Changes in Remote Work

The remote work environment is ever-changing, and companies must be agile in responding to new realities. As new technologies and trends emerge, it is crucial for expense policies to adapt accordingly.

For example, with the advent of virtual conferences, companies may need to modify their travel expense guidelines to account for online events. Additionally, as remote work becomes more commonplace, companies may need to address new expense categories unique to this setting.

Handling Policy Violations and Disputes

Even with a well-designed expense policy, there may be instances where policy violations occur or disputes arise. It is important for companies to have a clear process in place to address such situations.

This process should include steps for reporting violations, investigating claims, and resolving disputes in a fair and timely manner. Having a transparent and consistent approach can help maintain trust and integrity within the organization.

Engaging Employees in the Policy Review Process

When it comes to maintaining and updating an expense policy, it is essential to involve employees in the process. Their insights and feedback can provide valuable perspectives on the effectiveness and practicality of the policy.

Companies can consider conducting surveys or focus groups to gather input from employees. This collaborative approach not only ensures that the policy reflects the needs and realities of the workforce, but also fosters a sense of ownership and buy-in from employees.

Providing Training and Resources

Regularly maintaining and updating an expense policy is not just about making changes on paper. It is equally important to provide employees with the necessary training and resources to understand and comply with the policy.

Companies can develop training materials, conduct workshops, or provide online resources to educate employees about the policy’s key elements, procedures, and expectations. This proactive approach can help prevent misunderstandings and ensure consistent adherence to the policy.

Monitoring and Evaluating Policy Effectiveness

After implementing updates to the expense policy, it is crucial for companies to monitor and evaluate its effectiveness. This can be done through regular audits, feedback mechanisms, or data analysis.

By tracking and analyzing expense data, companies can identify any patterns or trends that may require further policy adjustments. This ongoing evaluation process enables companies to continuously improve their expense policy and ensure it remains aligned with the evolving needs of the remote work environment.

In conclusion, creating an expense policy for remote employees is crucial for companies operating in the digital age. By understanding the unique challenges and expenses associated with remote work, establishing key components of an effective expense policy, implementing the policy effectively, regularly maintaining and updating it, engaging employees in the process, providing training and resources, and monitoring its effectiveness, companies can ensure fair and transparent expense management for their remote workforce.