In the realm of accounting, the term “3 way match” holds substantial significance. It is a process that ensures accuracy and integrity in financial records, prevents fraud and overpayments, and streamlines the procurement process. With the increasing reliance on technology, it has become imperative for businesses to understand the concept of 3 way match and embrace its benefits.

Understanding the Concept of 3 Way Match

At its core, the concept of 3 way match refers to the comparison of three key documents – the purchase order, the goods receipt, and the supplier invoice. These documents provide a comprehensive view of the transaction, allowing businesses to validate the accuracy and completeness of each component.

The 3 way match is a crucial process in the procurement and accounting departments of organizations. It ensures that all the necessary checks and balances are in place to prevent errors, fraud, and financial losses. By verifying the information across three different documents, companies can maintain control over their financial transactions and ensure that they are in line with their business objectives.

Let’s dive deeper into the components and process of the 3 way match to understand its significance in accounting and financial management.

Definition of 3 Way Match

Simply put, a 3 way match is a process that matches the details of a purchase order, the receipt of goods or services, and the supplier invoice. It ensures that all three documents contain consistent and accurate information, thus eliminating discrepancies and mitigating risks.

The purchase order serves as a formal request from the buyer to the supplier, outlining the details of the products or services to be purchased. The goods receipt, on the other hand, confirms the physical receipt of the ordered items and verifies their quantity and condition. Lastly, the supplier invoice provides the financial details, such as the price, terms, and payment due date.

By comparing these three documents, organizations can ensure that they have received what they ordered, at the agreed-upon price, and that the supplier’s invoice matches the goods received. This process helps prevent overpayments, underpayments, duplicate payments, and other financial discrepancies.

Components of a 3 Way Match

A successful 3 way match relies on three essential components: the purchase order, the goods receipt, and the supplier invoice. Each document plays a crucial role in establishing a robust control mechanism that safeguards financial transactions.

The purchase order is the initial document that sets the terms and conditions of the purchase. It includes details such as the quantity, description, price, and delivery date of the goods or services. This document acts as a reference point for the subsequent steps in the 3 way match process.

The goods receipt is a confirmation that the ordered items have been received and are in good condition. It provides evidence that the goods have been physically inspected and match the specifications mentioned in the purchase order. This document is essential for verifying the accuracy of the supplier’s delivery and ensuring that any discrepancies are addressed promptly.

The supplier invoice is the final piece of the puzzle in the 3 way match process. It contains the financial details of the transaction, including the total amount due, any applicable taxes, and payment terms. This document is compared to the purchase order and goods receipt to ensure that the charges are accurate and in line with the agreed-upon terms.

By cross-referencing these three documents, organizations can identify any discrepancies or errors and take appropriate actions to rectify them. This process helps maintain financial accuracy, prevents fraud, and strengthens the overall control environment.

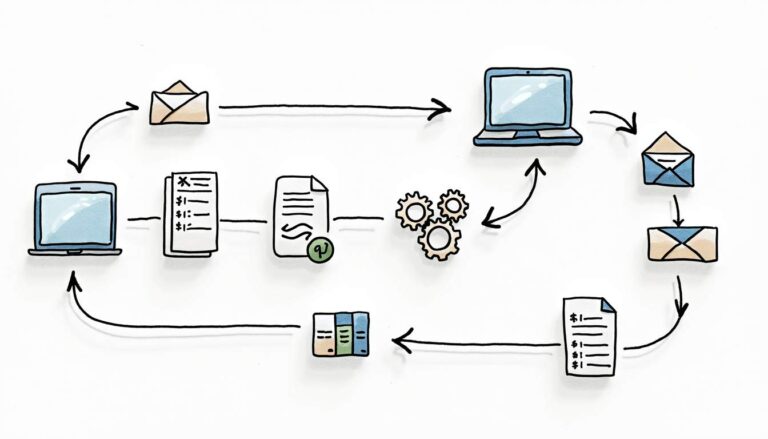

The Process of 3 Way Match in Accounting

The process of 3 way match in accounting involves cross-referencing the purchase order, the goods receipt, and the supplier invoice to ensure that the quantities, prices, and descriptions match. Any discrepancies are investigated and resolved before payment is made, ensuring financial accuracy and accountability.

Once the goods are received and inspected, the accounting department compares the details mentioned in the goods receipt with the purchase order. They verify that the quantity, quality, and condition of the received goods match the specifications mentioned in the purchase order. Any discrepancies, such as missing items or damaged goods, are noted and communicated to the relevant departments for resolution.

After verifying the goods receipt, the accounting department moves on to the next step of the 3 way match process – comparing the supplier invoice with the purchase order and goods receipt. They ensure that the prices mentioned in the invoice are in line with the agreed-upon rates and that any additional charges, such as taxes or shipping fees, are accurately reflected.

If all the details across the three documents match, the accounting department proceeds with processing the payment to the supplier. However, if discrepancies are identified, they are investigated further to determine the root cause. This may involve reaching out to the supplier for clarification, conducting internal audits, or engaging in negotiations to resolve any pricing or quantity discrepancies.

By diligently following the 3 way match process, organizations can maintain financial accuracy, prevent overpayments, and ensure that they only pay for the goods or services they have received. This process also helps build trust and strong relationships with suppliers, as it demonstrates a commitment to fair and transparent financial practices. Check out how you can implement Bellwether’s 3 way matching system for your business.

Importance of 3 Way Match in Accounting

The importance of 3 way match in accounting cannot be overstated. It serves as a cornerstone for financial integrity, accountability, and efficiency in businesses of all sizes. By implementing this process, organizations can fulfill their fiduciary responsibilities while reaping various benefits.

Ensuring Accuracy in Financial Records

Accurate financial records are vital for businesses to make informed decisions and comply with regulatory requirements. Through the 3 way match, any discrepancies between the purchase order, goods receipt, and supplier invoice are identified and resolved promptly, ensuring the accuracy and integrity of financial records.

Preventing Fraud and Overpayments

Fraudulent activities and overpayments can have a detrimental impact on a company’s finances. The 3 way match serves as a powerful tool in mitigating such risks. By validating each component of the transaction through this process, businesses can identify any discrepancies or irregularities that may indicate fraudulent activities. Additionally, it helps prevent overpayments by ensuring that the quantities and prices on the supplier invoice align with the purchase order and goods receipt.

Streamlining the Procurement Process

Efficient procurement is paramount for modern businesses to maintain a competitive edge. The 3 way match streamlines the procurement process by automating the verification and reconciliation of essential documents. This not only saves valuable time but also minimizes errors and reduces the administrative burden associated with manual processes.

Challenges in Implementing 3 Way Match

While the benefits of 3 way match are evident, implementing this process can present challenges for organizations. It is crucial for businesses to be aware of these obstacles and take proactive measures to overcome them.

Common Obstacles in 3 Way Match

Some common obstacles in 3 way match implementation include resistance to change, lack of proper training, and the complexity of integrating multiple systems. Overcoming these challenges requires a comprehensive understanding of the existing processes and the commitment to embrace change.

Overcoming Difficulties in 3 Way Match Implementation

Successful implementation of 3 way match relies on effective change management and collaboration between different departments. Providing adequate training to employees, setting up clear guidelines, and leveraging technology can significantly simplify the implementation process.

The Role of Technology in 3 Way Match

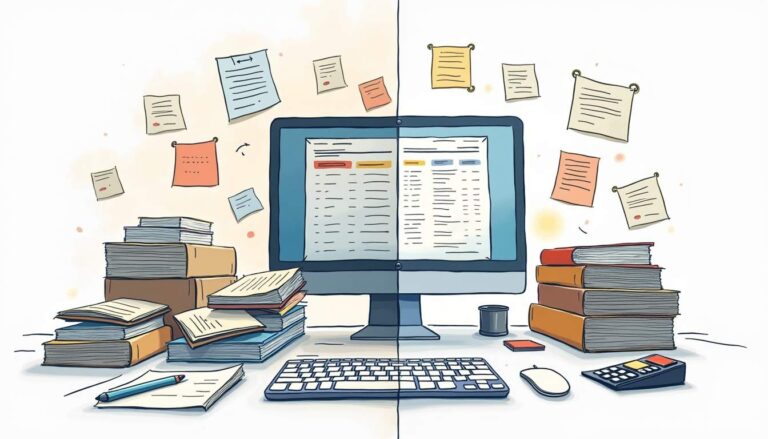

Technology plays a pivotal role in enhancing the effectiveness and efficiency of the 3 way match process. By leveraging automation and selecting the right software, businesses can optimize their operations and achieve better outcomes.

How Automation Simplifies the 3 Way Match Process

Automation simplifies the 3 way match process by automating the comparison of purchase orders, goods receipts, and supplier invoices. This not only reduces manual errors but also accelerates the verification process. By relying on technology, businesses can free up their employees’ time to focus on higher-value tasks.

Selecting the Right Software for 3 Way Match

Choosing the right software for 3 way match implementation is crucial. Businesses should look for solutions that integrate seamlessly with their existing accounting systems and provide robust features such as intelligent matching algorithms, reporting capabilities, and audit trails. Thorough evaluation and testing can help organizations select the most suitable software for their specific needs.

Future of 3 Way Match in Accounting

The future of 3 way match in accounting is shaped by emerging trends and evolving business practices. As technology continues to advance, businesses must stay informed about the potential impact on the 3 way match process.

Trends Shaping the Future of 3 Way Match

One of the prominent trends shaping the future of 3 way match is the increasing adoption of artificial intelligence and machine learning. These technologies have the potential to further automate the verification process, enhance data accuracy, and improve the overall efficiency of the 3 way match process.

The Impact of Evolving Business Practices on 3 Way Match

Evolving business practices, such as the rise of e-commerce and the expansion of global supply chains, have a significant influence on the 3 way match process. As businesses adapt to these changes, the 3 way match must also evolve to accommodate new transactional models and ensure the same level of accuracy and control.

In conclusion, the 3 way match process is a fundamental aspect of accounting that promotes financial accuracy, integrity, and efficiency. By understanding the concept, recognizing the importance, and leveraging technology, businesses can harness the benefits of 3 way match and navigate the evolving landscape of accounting with confidence.

If you are looking to implement an automated system for 3 way match, Bellwether can help. Book a personalized demo today to lean more.